In today’s digital age, small payments are a common part of the financial landscape. From micropayments in mobile apps, online services, and gaming platforms to small earnings from freelance gigs and tips, these small sums of money can quickly accumulate. However, cashing out these payments efficiently can often be tricky. Understanding how to navigate the world of small payments and choosing the right method for cashing out can help you make the most of these earnings. In this article, we’ll explore how to manage, consolidate, and cash out small payments effectively, including utilizing services like “소액결제 현금화” (small payment cash-out) to streamline the process.

Understanding Small Payments and Their Role

Small payments typically refer to amounts that are relatively low—often just a few dollars or less. These payments might come from different sources, including mobile apps, online surveys, freelance tasks, microtransactions in games, or even digital content creation. Individually, these payments may seem insignificant, but when accumulated over time, they can represent a meaningful amount of money.

The key challenge lies in how to manage and withdraw these small sums effectively without losing too much value in transaction fees or dealing with unnecessary delays. Cashing out small payments can be frustrating if you don’t have the right strategy in place, but with the right tools and knowledge, you can optimize the process.

The Challenges of Cashing Out Small Payments

One of the biggest obstacles when cashing out small payments is the fees that can be associated with the process. Many platforms and payment services charge transaction fees that are often proportionally high for small amounts. For example, if you’re trying to cash out a small payment of $5, but the service charges a $2 fee for a withdrawal, you’re left with just $3. This is a situation many people face when dealing with frequent, small transactions.

Additionally, withdrawal methods can sometimes be limited or cumbersome. Some services only offer specific withdrawal options, such as bank transfers or PayPal payments, and these may not always be the most convenient or cost-effective choices for cashing out small amounts.

Consolidating Small Payments to Maximize Value

One simple strategy for managing small payments is to consolidate them before cashing out. Rather than withdrawing each small payment as soon as it arrives, consider waiting until you have accumulated a larger sum. This approach allows you to reduce the frequency of transactions and avoid paying multiple fees for small withdrawals.

For example, if you receive small payments from a freelancing platform or micro-tasking service, waiting until your balance reaches a threshold—such as $50 or $100—before withdrawing can help reduce the overall cost of fees. Consolidating your small payments into a larger lump sum ensures that you’re not constantly losing value on individual, smaller transactions.

Choosing the Right Payment Platform

Selecting the right payment platform for cashing out your small payments is essential. Different platforms come with various fee structures and withdrawal methods. Some, like PayPal, offer convenience but charge fees for instant transfers or transferring money to your bank account. On the other hand, services like Venmo or Zelle may offer lower fees for standard transfers, but you may face longer processing times.

For those looking to streamline the process of cashing out small payments, it’s important to choose a platform that suits your needs. PayPal is a popular option due to its widespread use, but its fees can add up if you’re constantly withdrawing small amounts. Venmo and Zelle, both of which are free for most users, can be better choices if you’re looking for low-cost options.

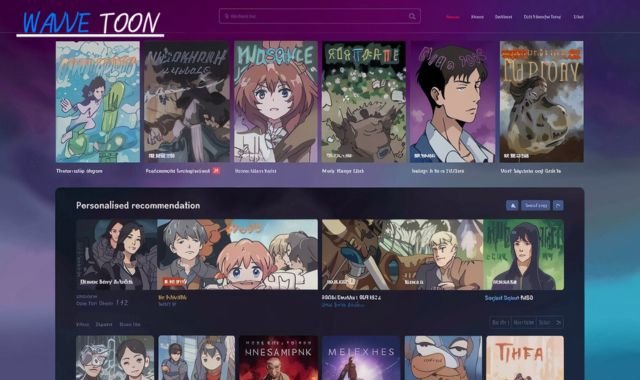

However, for smaller, more niche payments—such as those accumulated from gaming or reward-based apps—you might need to consider specialized services for cashing out. Services like “소액결제 현금화” are designed to help you convert small credits or virtual funds from various platforms into actual cash. These services are a convenient way to access your funds quickly, especially if the platform you’re using doesn’t allow direct withdrawals.

Utilizing “소액결제 현금화” for Easier Cashing Out

For those who frequently accumulate small payments from digital platforms or rewards programs, “소액결제 현금화” (small payment cash-out) services offer a valuable solution. These services allow you to convert small digital credits, virtual currency, or points from apps, games, or other online platforms into actual cash.

For example, many mobile games and online platforms reward users with virtual credits or loyalty points. While these are valuable within the ecosystem of the platform, they’re often not easily converted into cash or usable funds. This is where services like “소액결제 현금화” come in—they facilitate the process of turning these small amounts into real, spendable money.

Before using these services, however, it’s important to check for any hidden fees or conditions. While “소액결제 현금화” services can be a convenient way to access your earnings, some may charge fees or offer less-than-favorable exchange rates. Always research the service thoroughly to ensure it’s the right option for you.

Automating Small Payment Withdrawals

Another strategy to consider when cashing out small payments is to automate the process. Many financial platforms and apps now allow users to set up automatic withdrawals or transfers once a specific amount is reached. By setting up automated cash-outs, you can ensure that you’re not missing any opportunities to withdraw your funds while also reducing the risk of forgetting about small payments.

Automated withdrawals are especially useful if you receive payments on a recurring basis, such as tips from online content, mobile app earnings, or small payments for freelance work. By automating your withdrawals, you can ensure that your funds are regularly transferred to your bank account or payment service of choice without having to manually track them.

Taking Advantage of Cash-Back and Reward Programs

Many platforms and services also offer cash-back or reward programs that can add value to your small payments. If you’re earning through an app, game, or website that offers bonuses or discounts when you reach certain thresholds, make sure to take advantage of these opportunities. For example, some apps offer extra points or cash-back when you reach a certain milestone, which can further increase the value of your small payments.

Additionally, some payment platforms, such as PayPal or Venmo, offer cash-back promotions for specific purchases or transfers. By leveraging these opportunities, you can increase the overall value of your small payments and make the most out of your earnings.

Final Thoughts: Maximizing the Value of Small Payments

Cashing out small payments may seem like a simple task, but there are numerous factors that can impact the value you ultimately receive. Consolidating your payments, choosing the right platform, using specialized services like “소액결제 현금화,” and leveraging cash-back rewards can all help ensure that you get the most out of your small payments.

The key is to be strategic and proactive in managing these small payments. Whether you’re consolidating payments to reduce fees, choosing the right cash-out service, or automating your withdrawals, there are plenty of ways to navigate the world of small payments and maximize the value of your earnings. With the right approach, even small amounts of money can add up to significant rewards over time.